Investing in rental property can be a lucrative venture, offering a steady stream of income and long-term financial growth. However, without proper preparation and management, it can quickly become a source of stress and financial loss. Whether you’re a seasoned landlord or just starting out, understanding and implementing key strategies is crucial to safeguarding your investment.

1. Conduct Thorough Due Diligence Before Purchasing

Before acquiring a rental property, it’s imperative to perform comprehensive due diligence. This involves more than just a cursory inspection; it requires a detailed evaluation of the property’s condition, location, and potential risks.

Engaging a certified home inspector can uncover hidden issues such as outdated electrical systems, plumbing problems, or structural deficiencies. These issues not only pose safety hazards but can also lead to significant repair costs down the line.

Additionally, be wary of properties sold “as-is” or those located in areas with high vacancy rates. Such properties may come with unforeseen challenges that can impact your return on investment.

2. Establish Clear and Comprehensive Lease Agreements

A well-drafted lease agreement is the foundation of a successful landlord-tenant relationship. It should clearly outline the terms of the tenancy, including rent amount, payment due dates, maintenance responsibilities, and rules regarding property use.

Consulting with a legal professional to draft or review your lease can ensure that it complies with local laws and adequately protects your interests. In Pennsylvania, for instance, landlords are required to maintain rental properties in a safe and habitable condition, a responsibility that should be explicitly stated in the lease.

Moreover, including clauses about security deposits, late fees, and procedures for handling disputes can prevent misunderstandings and provide legal recourse if issues arise.

3. Implement Rigorous Tenant Screening Processes

Selecting reliable tenants is critical to maintaining a steady income and minimizing property damage. A thorough screening process should include:

- Credit Checks: Assess the applicant’s financial responsibility.

- Background Checks: Identify any criminal history that may pose a risk.

- Employment Verification: Ensure the tenant has a stable income to meet rent obligations.

- Rental History: Contact previous landlords to inquire about the applicant’s behavior and reliability.

Utilizing standardized screening criteria helps maintain objectivity and compliance with Fair Housing laws. It’s also advisable to require tenants to obtain renters insurance, which covers their personal belongings and can reduce liability in case of accidents.

4. Secure Appropriate Landlord Insurance Coverage

Standard homeowners insurance does not typically cover rental properties. Landlord insurance, also known as rental property insurance, is specifically designed to protect against the unique risks associated with renting out property. Different policies have different coverages and working with a licensed broker will help in evaluating your specific needs and finding the right coverage for you. If you are interested in a free risk analysis, feel free to reach out to us directly here 👉 https://www.mooneybrokers.com/quotes/

A comprehensive landlord insurance policy should include:

- Property Damage Coverage: Protects against damage from fire, storms, vandalism, and other perils.

- Medical Coverage: helps cover medical expenses for individuals injured on your property, regardless of who is at fault.

- Liability Protection: Covers legal expenses and damages if someone is injured on your property.

- Loss of Rental Income: Compensates for lost income if the property becomes uninhabitable due to a covered event.

It’s important to review and understand the terms of your policy, including any exclusions or limitations. For example, many policies require notification if the property will be vacant for an extended period, as coverage may be reduced or voided during such times.

5. Maintain Regular Oversight and Property Upkeep

Regular maintenance and inspections are essential to preserving the value of your rental property and ensuring tenant satisfaction. Establish a schedule for routine inspections to identify and address issues promptly. If the maintenance and upkeep is too much for you, it may be advisable to reach out to a management company like PMR to see if they can handle all of your needs.

Keep detailed records of all maintenance activities, repairs, and tenant communications. This documentation can be invaluable in resolving disputes and demonstrating compliance with legal obligations.

In Pennsylvania, landlords are legally required to maintain rental properties in a condition that is safe and habitable. Failure to do so can result in tenants exercising their right to withhold rent or make necessary repairs and deduct the cost from their rent.

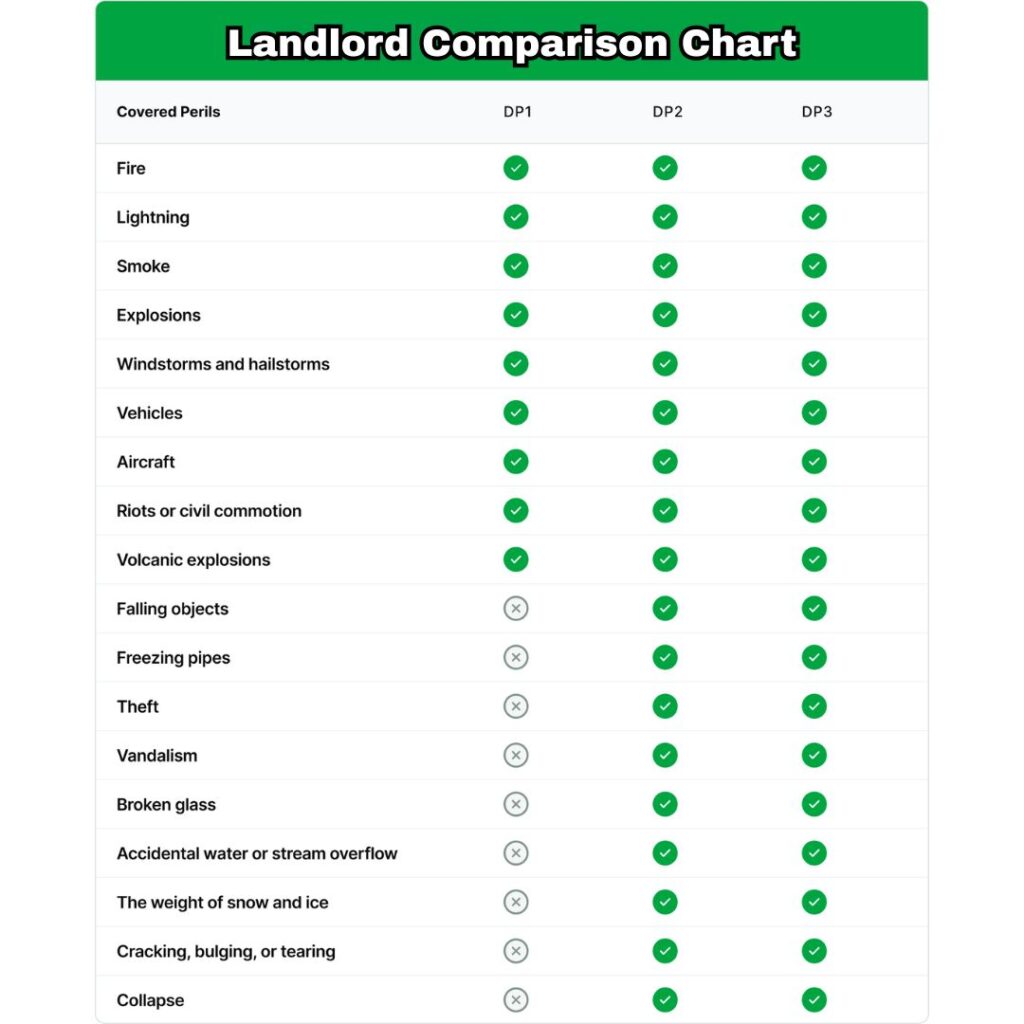

Types of Pennsylvania Landlord Policies: DP-1, DP-2, and DP-3

DP-1 (Basic Form): The most affordable, but offers the least protection. Covers specific perils (like fire, vandalism) and often pays out actual cash value (depreciated value).

DP-2 (Broad Form): A step up, covering more perils (e.g., burglary, ice damage, falling objects) and typically pays out replacement cost value.

DP-3 (Special Form): The most comprehensive. Covers everything except specifically excluded items. Best suited for landlords who want peace of mind and maximum protection.

Cost Factors of Rental Property Insurance in Pennsylvania

Insurance premiums can vary greatly based on the following:

- Location Risk: Areas with high crime, frequent storms, or near flood zones may see higher rates.

- Construction Materials: Brick and masonry buildings tend to cost less to insure than wood-frame homes.

- Rental Type: Long-term rentals are often cheaper to insure than short-term or vacation rentals.

- Vacancy Periods: Insurance companies often reduce or exclude coverage during extended vacancy unless notified in advance.

- Upgrades and Maintenance: Modern plumbing, electrical systems, and security features can reduce premiums.

How to Get Pennsylvania Rental Property Insurance Quotes

Getting the right landlord insurance in Pennsylvania shouldn’t be overwhelming — and with Mooney Insurance, it isn’t. Our simple online quoting tool lets you easily compare landlord insurance plans so you can find the right coverage at the best price.

Prefer to talk to a real person? Our licensed experts are just a call or email away, ready to guide you through the process and help you get covered with confidence. Reach us at (215) 358-0197 during business hours, or email us anytime at info@mooneybrokers.com.

Conclusion

Becoming a successful landlord involves more than just collecting rent; it requires proactive management, legal compliance, and a commitment to maintaining your property. By conducting thorough due diligence, establishing clear lease agreements, implementing rigorous tenant screening, securing appropriate insurance, and maintaining regular property oversight, you can protect your investment and ensure a positive experience for both you and your tenants.

Remember, the key to a profitable and stress-free rental property lies in preparation, diligence, and ongoing management. And keep in mind that owning a rental property is exactly like running a business and as an owner you need to find ways to be profitable.