Auto Insurance in Ambler, PA – Mooney Insurance Brokers

Protecting Your Vehicle, Your Wallet, and Your Peace of Mind

💬 “You don’t just need car insurance—you need the right car insurance. Let us help you find it.”

At Mooney Insurance Brokers, we specialize in providing comprehensive auto insurance solutions for residents of Ambler, PA, and the surrounding areas. Whether you’re insuring a daily driver or a classic car, our independent agency offers personalized coverage options to fit your needs and budget.

🛡️ Why Choose Mooney Insurance Brokers?

- Independent & Local: As a 100% independent agency, we compare quotes from top-rated insurance carriers to find you the best coverage at the most competitive rates.

- Expert Guidance: Our experienced agents help you navigate policy details, ensuring you understand your coverage and avoid costly gaps.

- No Extra Cost to You: Our services are compensated directly by the insurance carriers, so you get expert assistance at no additional charge.

📋 Understanding Pennsylvania Auto Insurance Requirements

In Pennsylvania, all drivers are required to carry certain types of auto insurance coverage. Here’s a breakdown of the mandatory and optional coverages:

🔹 Required Coverages

- Bodily Injury Liability: Covers medical and rehabilitation expenses if you injure someone in an accident. Minimum required: $15,000 per person / $30,000 per accident.

- Property Damage Liability: Pays for damage you cause to another person’s property. Minimum required: $5,000.

- Medical Benefits (PIP): Pays medical bills for you and others covered by your policy, regardless of fault. Minimum required: $5,000.

- Limited or Full Tort: Determines your right to sue for pain and suffering. Limited tort offers savings but restricts your ability to sue, while full tort provides unrestricted rights to sue.

🔹 Optional Coverages

- Collision Coverage: Pays for damage to your vehicle resulting from a collision, minus your deductible.

- Comprehensive Coverage: Covers non-collision incidents like theft, vandalism, or hitting an animal.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re injured by a driver with insufficient or no insurance.

- Rental Reimbursement: Pays for a rental car if your vehicle is in the shop due to a covered loss.

- Towing & Labor: Covers the cost of towing and roadside assistance.

- Agreed Value Coverage (Great for Classic or High-Value Cars): Get a payout based on a pre-determined vehicle value—not depreciated market value.

- Extraordinary Medical Benefits: Go beyond the standard $5,000 with enhanced medical coverage—up to $1 million.

- Accident Forgiveness: Keep your rates from increasing after your first at-fault accident.

- Diminishing Deductible: Earn a lower deductible each year you drive safely, saving money when you need it most.

For more detailed information on Pennsylvania’s auto insurance requirements, visit the Pennsylvania Insurance Department and you can download a free insurance guide resource 👉 HERE

💸 Money-Saving Discounts You Could Be Missing

Maximize your savings by bundling and qualifying for key discounts:

| Discount Type | Description |

|---|---|

| 🏡 Multi-Policy | Bundle home and auto for big savings. |

| 🚗 Good Driver | Accident-free? Enjoy lower premiums. |

| 📘 Good Student | GPA of 3.0 or higher? You could save. |

| 💳 Pay-in-Full | Pay annually and skip installment fees. |

| 🧑🎓 Driver’s Ed | Youthful drivers with education get rewarded. |

📊 Factors Affecting Your Auto Insurance Premium

Insurance carriers consider several factors when determining your premium:

- Driving History: A clean driving record can lead to lower rates.

- Vehicle Type: Make, model, and safety features impact premiums.

- Insurance Score: In Pennsylvania, insurers may use credit information to assess risk.

- Age & Experience: Younger and less experienced drivers may face higher rates.

- Annual miles driven: The more miles that you log, the higher the rate will be.

🛠️ Collector Car Insurance

If you’re a classic car enthusiast, we offer specialized insurance options tailored for collector vehicles. These policies often provide agreed value coverage, which can be more beneficial than standard market value policies.

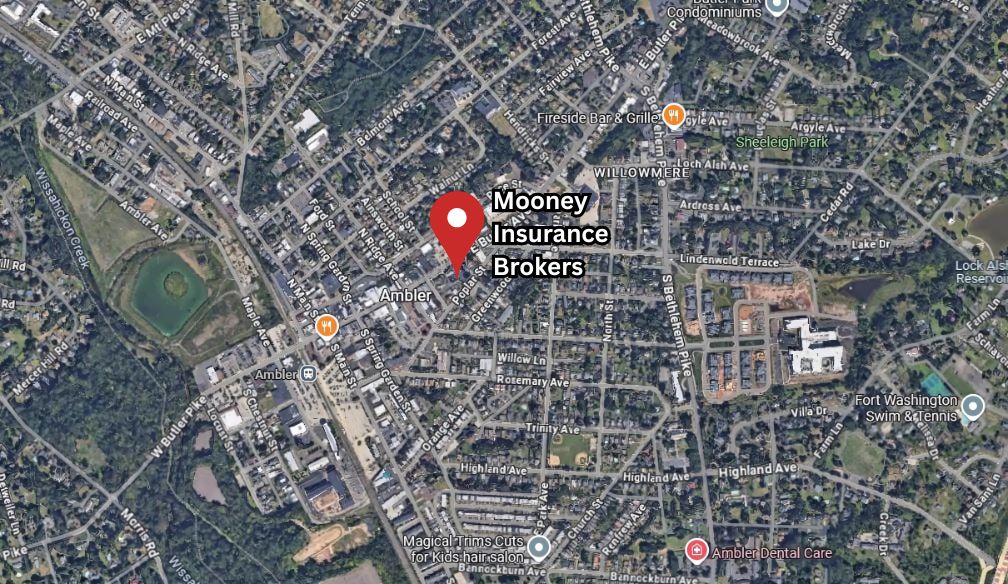

📍 Serving Ambler and Surrounding Areas

Located at 150 E Butler Ave, Ambler, PA 19002, Mooney Insurance Brokers is proud to serve the local community. Whether you’re in Ambler, Lower Gwynedd, Horsham, Blue Bell, Fort Washington, Lansdale or beyond, we’re here to help you find the right auto insurance coverage.

🔍 How to Get an Auto Insurance Quote in Ambler

Getting started is easy and takes just a few minutes:

- Click here to request a quote online

- Or call us directly at (215) 358-0197

- We’ll compare top carriers and present you with the best options

- You choose the coverage that works best for you—without pressure or extra fees

❓ Frequently Asked Questions (FAQs)

Q1: What is the minimum auto insurance required in Pennsylvania?

A1: Pennsylvania requires drivers to carry:

- $15,000 bodily injury liability per person / $30,000 per accident

- $5,000 property damage liability

- $5,000 medical benefits (PIP)

Q2: Is there a difference between full tort and limited tort in PA?

A2: Full tort allows you to sue for pain and suffering regardless of fault, while limited tort offers savings but restricts your ability to sue unless injuries meet certain criteria.

Q3: Is comprehensive coverage worth it?

A3: Comprehensive coverage is advisable if your vehicle is valuable or if you’re concerned about non-collision incidents like theft or vandalism. With recent thefts of catalytic convertors, we would advise that you include this coverage on your policy. When added to the policy, it also lends coverage for windshield repair and replacement.

Q4: Can I insure a classic car?

A4: Yes, we offer specialized insurance for collector vehicles, providing coverage tailored to their unique needs. Hagerty and Grundy offer the best coverage available for older and vintage vehicles and even offer coverage if you take your car to car shows.

Q5: How can I lower my auto insurance premium?

A5: Consider bundling policies, maintaining a clean driving record, and opting for higher deductibles to reduce your premium.

🔗 Helpful Resources

- NAIC – consumer auto insurance overview

- Investopedia – Does Car Insurance Cover Theft?

- III – Personal auto insurance basics