What Makes Mooney Brokers Different?

Better Coverage. Better Service. Peace of Mind.

At Mooney Insurance Brokers, we believe your home deserves more than a standard policy — it deserves a custom protection plan backed by exceptional service from local experts who care.

Your home isn’t just a building — it’s your life, your memories, and likely your largest financial asset. Protect it with a homeowners insurance policy designed to fit your lifestyle and secure your future.

The Mooney Insurance Difference:

- Independent and Local — We represent you, not the insurance companies.

- Tailored Coverage — Every quote is custom-fit to your specific needs.

- Top-Rated Carriers — We partner with financially strong, trusted insurers.

- Dedicated Advisors — No call centers. Real, local agents who care about you.

- Competitive Pricing — Better coverage doesn’t have to mean a bigger bill.

What Does a PA Homeowners Policy Cover?

Every home is unique. Every family’s needs are different. That’s why we take the time to design a policy that fits you.

Typical coverages include:

🏡 Dwelling Coverage

Pays to rebuild or repair your home if damaged by covered perils.

🏘️ Other Structures Coverage

Protects fences, detached garages, sheds, and driveways.

📦 Personal Property Coverage

Replaces belongings like furniture, clothing, electronics, and appliances after a loss.

🏠 Loss of Use

Covers temporary housing and living expenses if your home becomes uninhabitable.

🏥 Medical Payments

Pays medical expenses for guests who are accidentally injured on your property.

🛡️ Personal Liability Protection

Protects you financially if someone sues you for injury or property damage.

💎 Scheduled Personal Property

Optional protection for high-value items like jewelry, collectibles, or fine art.

Learn more about homeowners insurance coverages HERE.

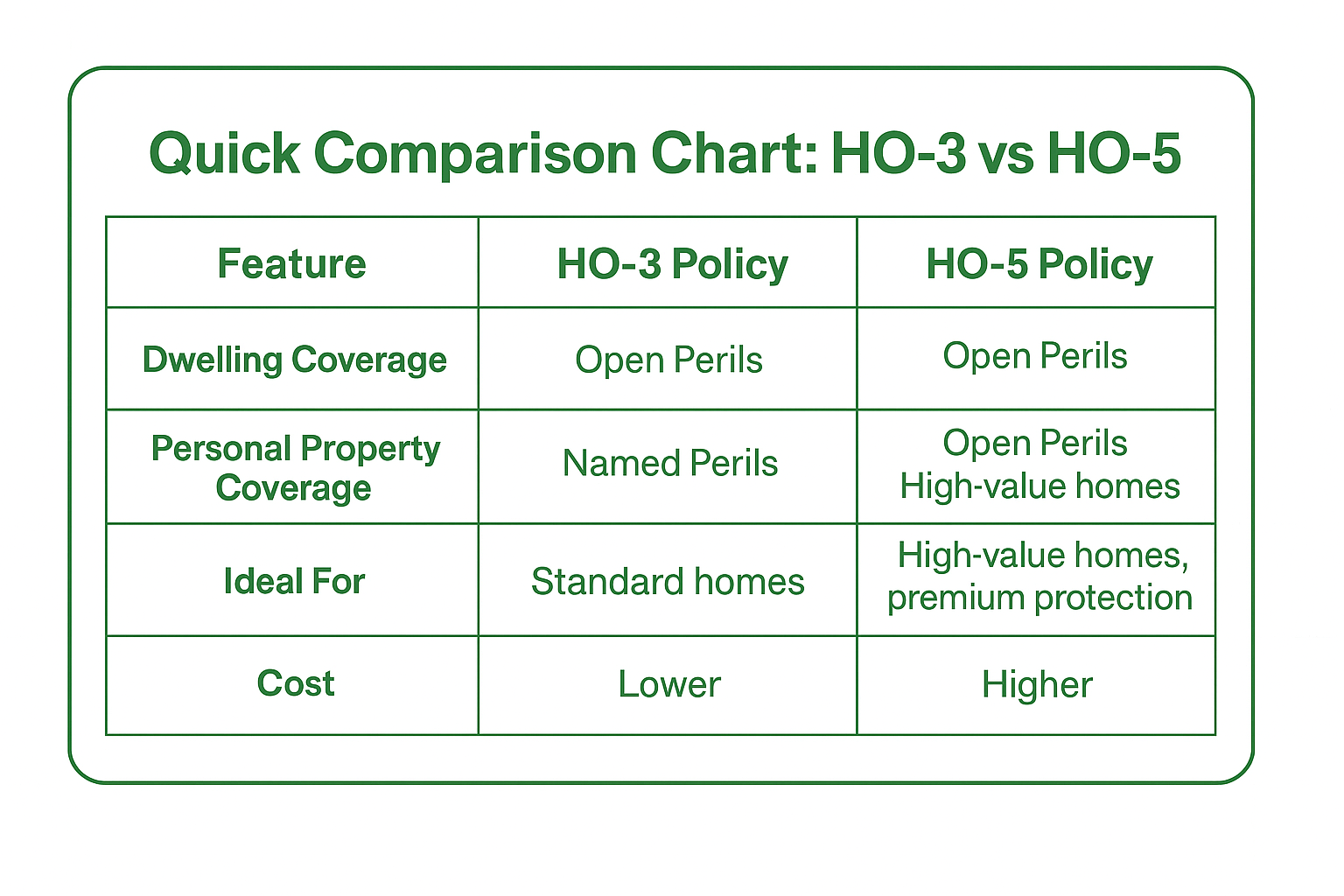

Understanding the Different Types of Homeowners Insurance: HO-3 vs HO-5

When comparing policies, one size doesn’t fit all.

The two most common types of homeowners policies are HO-3 and HO-5 — and knowing the difference can save you thousands in the long run.

Here’s a quick breakdown:

🏡 What is an HO-3 Policy? (Special Form)

- Covers the home structure for all risks except exclusions.

- Covers personal property for named risks only (e.g., fire, theft).

- Lower premium; good for many homeowners.

🏠 What is an HO-5 Policy? (Comprehensive Form)

- Covers both the home structure and personal property for all risks unless specifically excluded.

- Provides broader protection, higher limits for valuables.

- Ideal for newer or high-value homes.

At Mooney Brokers, we have access to insurance companies offering both HO-3 and HO-5 policies — giving you more choice and better protection options based on your needs and budget.

Quick Comparison Chart: HO-3 vs HO-5

Specialty Homeowners Policies Available

- Rental Property Insurance (Landlord Policies)

- Vacant Home Insurance

- Flood Insurance

- Umbrella Liability Policies

- Builders Risk & Renovation Insurance

We make sure no gap goes uncovered.

Why Homeowners in Ambler, PA Trust Mooney Brokers

🌟 20+ Years of Trusted Service

🌟 5-Star Rated Customer Satisfaction

🌟 Easy, Transparent Quote Process

🌟 Local Knowledge, National Expertise

Protecting homes from Spring House to Upper Dublin to Blue Bell to Fort Washington and beyond, we’re proud to serve Ambler and the surrounding Montgomery County area.

See what our customers are saying.

How to Get Started

Ready to protect your home with better coverage and better service?

Here’s how easy it is:

- Call us at (215) 358-0197

- Request your free quote online Start here

- Email us your current policy for a no-obligation coverage review

We’ll do the hard work of shopping and comparing for you.

Frequently Asked Questions (FAQ)

1. How much does homeowners insurance cost in Pennsylvania?

The average annual homeowners premium in PA is about $1,400 — but costs vary based on location, home size, construction type, and coverage selected.

2. Do I need separate flood insurance?

Yes. Standard homeowners insurance does not cover floods. Ask us about affordable flood insurance options. We have access to NFIP coverage as well as Private Market Flood.

3. How do I know if I need an HO-5 policy?

If you own a high-value or newer home, or you have many expensive possessions, an HO-5 policy may offer better protection. The coverage under this policy is much broader coverage for your personal property.

4. What discounts are available?

You may qualify for discounts by:

- Bundling home and auto insurance

- Installing security systems

- Water detection and water shutoff systems

- Newer roof discount

- Having smoke detectors or smart-home features

- Claims-free discount

- Multi-policy

5. Can you help with rental property insurance?

Absolutely! We specialize in rental property, vacant home, and landlord insurance solutions.

Final Thought: Your Home Deserves the Best

At Mooney Insurance Brokers, our mission is simple: protect Pennsylvania families better — with better coverage, better service, and better value.

Don’t settle for a one-size-fits-all policy.

Protect your home and future with the experts at Mooney Brokers.