Table of Contents

Introduction

Most people are familiar with how credit scores affect their ability to secure a mortgage or a car loan. But what many consumers don’t realize is that your credit history can also affect how much you pay for insurance—especially home and auto insurance. Insurance companies have found that there’s a strong link between how you manage your credit and how likely you are to file a claim.

In this article, we’ll break down why insurers use credit-based insurance scores, how these scores are calculated, and what you can do to improve your insurance rates. Plus, we’ll reference two helpful articles from CNBC and the National Association of Insurance Commissioners (NAIC) to add clarity to this often misunderstood topic.

Why Insurance Companies Use Credit Scores

Insurance companies aren’t using credit scores to determine whether you can make a payment or get approved for coverage. Instead, they use a credit-based insurance score to help predict your risk level. Statistically speaking, individuals with lower credit scores tend to file more claims than those with higher credit scores.

By evaluating a person’s financial behavior over time, insurers can identify patterns that correlate with claim frequency and severity. This means that people who manage their credit well are less likely to file insurance claims, and as a result, often receive lower premiums.

Key Takeaway:

Insurers use your credit score as part of a larger risk model—not to judge your finances, but to estimate the likelihood of future claims.

What Is an Insurance Score?

An insurance score is a number that insurance companies use to assess how risky a customer might be to insure. While it’s related to your credit score, it’s not the same thing.

According to CNBC:

“An insurance score, also known as a credit-based insurance score, is a number based in part on your credit score, used by insurers to determine your rates.”

Source: CNBC – What is an insurance score?

These scores typically include data such as:

-

Your outstanding debt

-

Length of credit history

-

Payment history

-

Types of credit in use

-

Recent credit inquiries

Insurance scores do not consider:

-

Your income

-

Gender

-

Marital status

-

Occupation

-

Ethnicity or race

Why This Matters:

Your credit habits—like paying bills on time and keeping debt low—are indicators of responsibility. That responsibility translates to lower risk for insurance companies.

How Credit Impacts Auto and Home Insurance Rates

Credit-based insurance scores play a major role in both auto and homeowners insurance pricing. Insurers have found consistent trends that connect poor credit with higher claim rates. Here’s how credit can affect each type:

Auto Insurance:

People with poor credit are statistically more likely to:

-

File claims more often

-

Be involved in more severe accidents

-

Miss insurance payments

Because of this, drivers with bad credit could pay up to 65% more than those with excellent credit, according to multiple studies.

Homeowners Insurance:

For homeowners, a low insurance score may indicate a higher likelihood of filing property damage claims. This leads to higher premiums—even if you’ve never filed a claim before.

Source: NAIC – Credit-Based Insurance Scores

The NAIC article clarifies that while credit-based scores are just one factor, they’re heavily weighted in many states.

How Insurance Companies Develop Insurance Scores

Insurance companies don’t create these scores themselves. Instead, they rely on data from credit bureaus (such as Experian, Equifax, and TransUnion) and use third-party analytics firms to calculate a proprietary insurance score.

The Process:

-

Credit Bureaus Gather Data – Your payment history, credit utilization, length of credit history, and other variables are compiled.

-

Analytics Firms Score the Data – Companies like FICO or LexisNexis use predictive modeling to generate a score based on your credit behavior.

-

Insurers Apply the Score to Their Rating Models – Each insurer has its own algorithm, but the score heavily influences your premium.

Insurance companies typically combine this score with:

-

Claims history

-

Driving record (for auto)

-

Property condition and location (for home)

-

Policyholder age and other risk factors

This allows them to set a premium that reflects your unique risk level.

Steps Consumers Can Take to Improve Their Insurance Score

Improving your insurance score is very similar to improving your credit score. Here are actionable steps you can take right now to lower your insurance premiums over time:

1. Pay Your Bills On Time

Your payment history is the single biggest factor. Even one missed payment can hurt your score.

2. Reduce Credit Card Balances

High credit utilization (using too much of your available credit) can negatively impact your score. Try to stay under 30% utilization on all accounts.

3. Avoid Opening Too Many New Accounts

Each hard inquiry can temporarily ding your score, and too many new accounts can look risky to insurers.

4. Keep Old Accounts Open

The longer your credit history, the better. Don’t close old credit cards unless absolutely necessary.

5. Check Your Credit Reports for Errors

Request your free credit report from AnnualCreditReport.com and look for mistakes. Disputing errors can improve your score quickly.

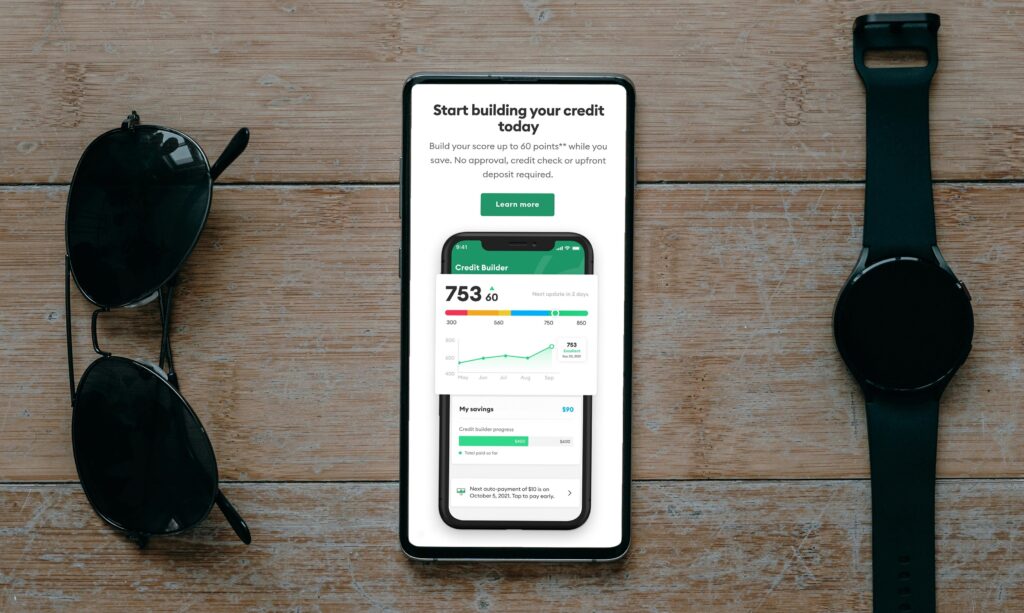

6. Monitor Your Score Regularly

Use tools like Credit Karma or your bank’s credit score monitoring to track progress and identify drops early.

By following these steps, you can raise your insurance score and potentially save hundreds of dollars per year on insurance premiums.

Conclusion

Credit-based insurance scores may feel invasive, but they serve a specific and evidence-based purpose: helping insurers gauge risk more accurately. While it might seem unfair that your credit affects your insurance costs, the good news is you have control over your score.

Understanding how these scores are calculated and taking small steps to improve them can lead to big savings—especially over the life of a long-term auto or home insurance policy.

To learn more, we encourage you to read:

Frequently Asked Questions (FAQ)

Q: Do all states allow insurance companies to use credit scores?

No. States like California, Hawaii, and Massachusetts restrict or ban the use of credit-based insurance scores. However, most states do allow it.

Q: Will checking my credit hurt my insurance score?

No. When insurers or consumers check a credit score for insurance purposes, it’s considered a soft inquiry and does not affect your score.

Q: Can I ask for a quote that doesn’t use my credit score?

You can ask, but in most states, insurers are allowed to factor in your insurance score. Some insurers might offer alternative underwriting, but they are rare.

Q: How often do insurance companies check my credit score?

Typically, at the time of a new quote or policy renewal. Some may check annually, others less frequently.

Q: Is an insurance score the same as a credit score?

No. While both use similar data, insurance scores are specifically designed to predict claim risk, not loan repayment likelihood.

If you’re shopping for a new policy or want to get a better rate, start by checking your credit report and taking steps to strengthen your financial habits. Not only will this help your credit—it’ll make your insurance more affordable too. And if you have additional questions regarding the impact of credit on your insurance premiums feel free to reach out to us — https://www.mooneybrokers.com/contact/ and follow us social platforms for constant updates about all things insurance.

Facebook

Instagram

YouTube